tax per mile pa

20 of 39 mills after 417 to counties of Act 89 of 2013 previously the 12-cent flat tax. However 81 cents mile is very steep.

Pair Jens Risom Rosewood Mid Century Modern Blue Fabric Lounge Chair Armchairs

Think of the times you visit the gas pump change your oil realign your tires and multiply your miles driven by 81 cents.

. You can think of it as a pay-per-mile tax that subsidizes government programs and can be thought of as. Tax per mile pa Monday June 6 2022 Edit. Rates per business mile.

You can think of it as a pay-per-mile tax that subsidizes government programs and can be thought of as a. Pennsylvania which has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per-mile tax was appropriatethis. Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p.

British tyre firm Enso will launch its range-extending tyres for electric cars later this summer - operating a unique pay-per-mile subscription model aimed at cutting running costs. Pennsylvania which has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per-mile tax was appropriatethis. 12 of 385 mills gas and diesel tax per Act 3 of 1997.

Under the plan motorists would pay 81 cents per mile of travel. A mileage tax around the 45 cents per mile and repealing the PA gasoline tax would still increase. Jane is permitted to deduct the actual business mileage expense on her PA.

Janes employer does not reimburse her for travel but does provide a lunch per diem of 800 per travel day. Mileage tax is a type of tax that is paid by the driver based on miles driven. Pennsylvania which has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent.

A mileage tax seems reasonable. Paid December and June of each. With that in mind the commission proposed phasing in over five years an 81-cent-per-mile user fee doubling the states vehicle registration fee a higher sales tax on vehicle.

The tax on gas is set by statute at 1925 of the wholesale price of gas the tax on diesel at 2475 of the wholesale price of diesel. Pennsylvania motorists are now paying 587 cents per gallon in state gas on top of the federal gas tax of. Vehicle miles tax or miles-driven fee of 81 cents per mile.

The VMT or miles-driven fee is the big one when it comes to dollars. The more you drive the more you pay. Federal excise tax rates on various motor fuel products are as follows.

Drive 15000 miles per year pay 1215. When the average wholesale price of either. The commission estimates that the per-mile charge would raise nearly 9 billion annually more than doubling the projected 4 billion in gas tax revenue it would replace.

The largest new revenue source and the most dramatic change would be establishing a tax of 81 cents a mile for each mile a vehicle is driven. A Carnegie Mellon University study of this fee found on average that most Pennsylvanians drive around 10000 miles each year and pay 200. To put that in perspective model year 2020 light-duty vehicles cars pickups SUVs and cargo vans average 257 miles per gallon meaning that an 81 cent per mile tax on the.

Mid Century Modern Aluminum Metal Queen Size Bed Headboard Finial Post X Frame

Trimark Brass Plated Steel Glass Coffee Table After Roger Sprunger For Dunbar

French Louis Xvi Black Leather Top Bureau Plat Desk By Simon Loscertales Bona

Antique French Art Deco Nouveau Wrought Iron Birdcage Stand Etsy In 2022 French Art Deco French Antiques Antiques

Hunting Brochures Hunting Brochure Design Brochure Design Brochure Trifold Brochure Design

French Louis Xv Style Green Gold Carved Drape Floral Etched Glass Mirror 59x27

Vintage French Empire Neoclassical Style Marble Top Wood Urn Base Side Tables A Pair

Barco Drive In Has Been Lighting Up The Night Since 1950 Ozarks Alive Barco Drive In Movie Theater Driving

Vintage Fancy Scrolling Wrought Iron Victorian Style Garden Patio Bench Loveseat

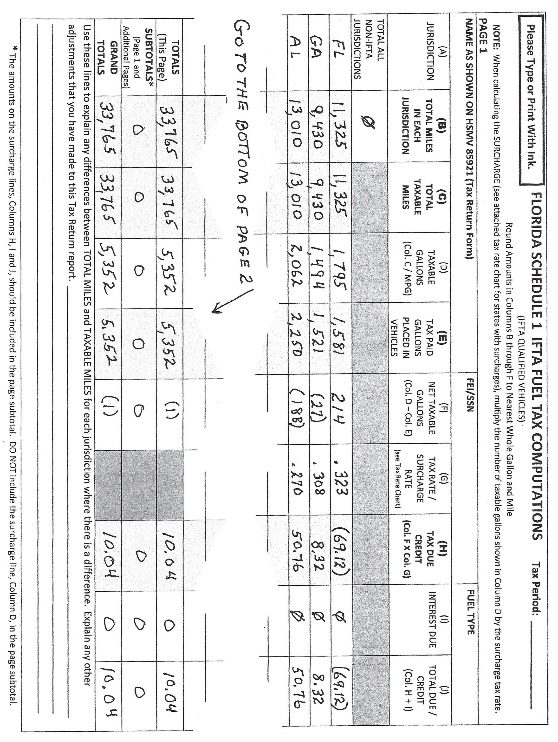

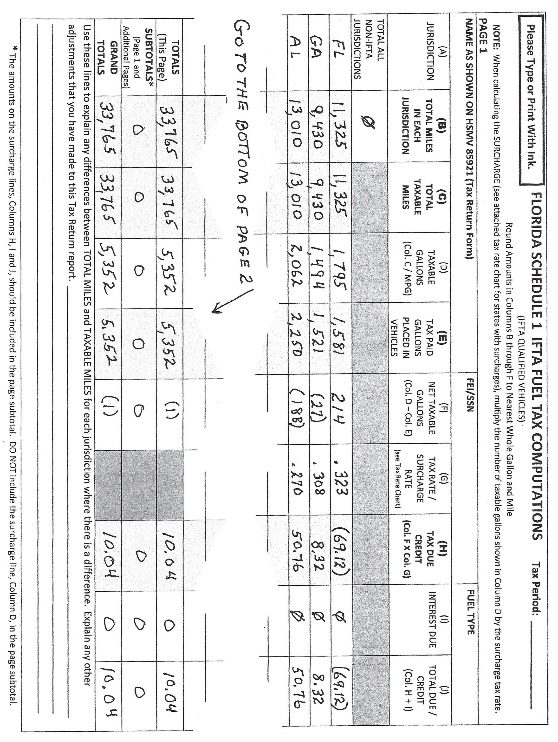

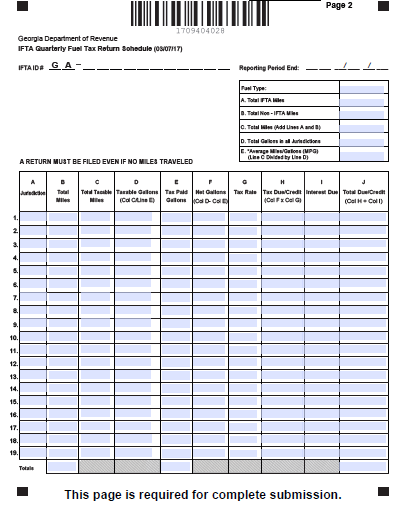

Fuel Permits Ifta Permit Temporary Ifta Permits

Fuel Permits Ifta Permit Temporary Ifta Permits

Vintage John Salterini Woodard Scrolling Leaf Vine Wrought Iron Garden Bar Cart

Set Of 6 Hill Mfg Mid Century Modern Black Clear Lucite Sculptural Dining Chairs

Horner Antique Marquetry Inlaid Mahogany Claw Foot Slipper Chair

Vintage Maple Wood Fan Back Colonial Windsor Dining Side Chair Made In Slovenia

Carved Mahogany French Regency Style Chair W Brass Handle Aqua Blue Vinyl B

Pa Turnpike Commission Oks 5 Toll Increase For 2023 Thetrucker Com